FMP vs FD

In the Financial year 2018-2019, it would be best for you to revisit FD investments that you had invested a year ago, and choose to reinvest this year in an instrument, which provides better returns. As American financial specialist Peter Lynch has stated: "Realize what you claim, and know why you possess it.". Fixed Deposits (FDs) are a well-known investment instrument on account of the guaranteed interest that they offer. Nonetheless, the Mutual Fund industry has created an efficient instrument that is Fixed Maturity Plans (FMPs).

What are FMPs? How would they contrast with FDs?

Fixed Maturity Plans (FMPs) are closed-ended debt instruments. They have a fixed investment period, for three or more years. They are open for a predetermined period - that is the reason they are called closed-ended funds. These debt instruments invest in such as government securities, corporate bonds, commercial paper, certificates of deposits and treasury bills. Thus, we tentatively know the indicative returns of FMPs.

Fixed Deposits enables an investor invests his or her funds with a bank for a specified period of time. FD interest rate and maturity amount are known to the investor since the beginning of the investment.

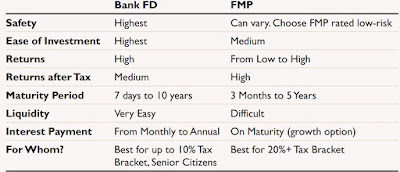

Highlights of FMPs versus FDs

Fixed Deposit Interest Rates:

- FDs may guarantee you of fixed returns and thus offer greater security, however, FMPs offer higher returns than FDs.

- "In outright terms, FDs today give an interest of around 6.5% to 7.5% and in FMPs, it is from 8 -8.5%.

- "FMPs offer higher yields than Fixed Deposits. Bank FDs bring down returns contrasted with FMPs. If you wish to buy a car three years from now, invest in a Fixed Maturity Plan with a maturity of three years.

- FMPs offer indexation benefit, which states that one can achieve higher returns through FMPs. The returns you get from FMPs are called capital gains and with indexation, it lowers tax outflow resulting in higher returns.

In FDs, the interest gets added to the income of the investor and taxed at applicable tax slab. In FMPs, 20 percent post-indexation benefit above three years, help investors with flat tax payout. To summarise, in FDs, after 30 percent tax, interest is around 4.30 percent to 5 percent against post-tax returns of FMPs - considering a 30 percent tax slab of investors - comes around 7.25 percent to 7.50 per cent.

FMPs give 3% more tax efficient returns than Fixed Deposits.

Gains on FMPs after 3 years are eligible for long-term capital gains (LTCG). Taxation in LTCG is at 20 percent with the indexation benefit. Indexation allows you to inflate the purchase price.

"For an Indian resident, FMPs don't have any TDS. You have to pay taxes just in the time of maturity (on FMPs. In FDs, the bank deducts Tax at Source (TDS) based on interest accrued, thus have to pay tax every year.

If FMPs are less than three years old, then the taxation of FD and FMPs are the same. For FMPs with the maturity of over three years, capital gains indexation benefit makes FMPs far more tax efficient.

Assume you require cash earnestly. Clearly, you would need to fall back on your investments. FDs here prove to be useful in light of the fact that FDs offer an untimely withdrawal facility. FMPs are locked-in for the period of 3 years and in case you need funds, they cannot be withdrawn.

Dangers on FMPs, FDs:

Since returns on FDs are known, they by and large influence an investor to feel more secure than FMPs.

"FMPs are presented to the danger of at least one of their fundamental papers defaulting (credit hazard), and this could possibly hamper their profits. They are additionally presented to a hazard known as 'reinvestment Risk' .”

Be that as it may, many people don't know about it yet even FDs are likewise guaranteed just up to a total of Rs. 1 lakh. Along these lines, an FD investor should know about the presence of such dangers.

"In the present market situation, the yields have risen, including the short end of the yield curve, making FMPs a powerful alternative to secure better returns.

The coupon rates of securities have climbed however FD rates have stayed low. In such a situation, locking into top notch (AAA-appraised) arrangement of FMPs can convey better returns than FDs.

Dhancreators Recommendation:

Be that as it may be picking amongst FDs and FMPs, as a financial specialist, we suggest investing in the one which suits him/ her the best. Based on your liquidity requirement, returns, and tax efficiency perspective, a person can choose to invest either in FDs or FMPs.

Happy Investing !!!